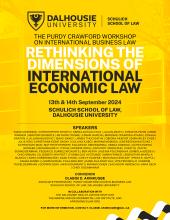

Purdy Crawford Workshop on International Business Law: Rethinking the Dimensions of International Economic Law

Join Schulich Law Associate Professor Olabisi D. Akinkugbe, Purdy Crawford Chair in Business Law, along with nearly 50 other leading scholars, graduate students, and legal practitioners for the Purdy Crawford Workshop on International Business Law: Rethinking the Dimensions of International Economic Law.