July 2, 2024

AFRONOMICSLAW PRESS RELEASE

July 2, 2024

Wanjiru Gikonyo and Afronomicslaw File East Africa Court of Justice Case Against Kenya Seeking Transparency on Debt Swaps

(EACJ Reference No. 19 of 2024: Eugenia Wanjiru Gikonyo v. The Attorney General of the Republic of Kenya)

On April 16th, 2024, Wanjiru Gikonyo, a leading advocate of good governance and accountability together with the Afronomicslaw filed a case seeking transparency in Kenya’s debt swaps before the East African Court of Justice, (EACJ). The case seeks the Kenyan government to offer detailed information about its planned and ongoing Debt Swaps Arrangements (DSAs).

The Kenyan government has identified debt swaps as an innovative liability management solution but failed to fully disclose any details about these swaps or to subject their procurement process to public participation. In its reply to this case, the Kenyan government argues that by merely publishing information about the debt swaps, it has complied with principles of transparency and good governance. Further, in its reply to this case, the Kenyan government has for the first time disclosed it has “received a proposal on the debt for food security from the World Food Program (WFP) which requires a guarantee from the Development Finance Cooperation (DFC) and an advisory firm for bond issue.”

This disclosure about a debt for food security swap and the fact that it will require a bond issue, is precisely the kind of risk that this case seeks to be more fully disclosed and to be avoided. Evidence from countries like Gabon that have issued garden variety bond instruments as debt swaps clearly demonstrates that these transactions do not focus enough on debt relief, sustainability, climate change or food security. Further, there is no evidence at all that debt swaps create expanded financing for education, health care or food security. Instead, the evidence overwhelming shows that debt swaps have several negative outcomes.

For example, debt swap transactions come at a high cost. This is because just like Eurobonds a whole variety of transaction expensive advisory services must be procured. These high costs that are never disclosed are borne by the citizens of the borrowing country. Creditors dictate the priorities to be pursued in debt swap transactions. Prior debt swaps from other parts of the world have come with minimal disclosure of full terms of the swap contracts including the costs payable to advisory firms, applicable currency, repayment maturity profiles, interest rates, extent of waiver of sovereign immunity, and applicable collaterals if any. Yet another key reason why this case is necessary is the lack of public participation in their formulation, negotiation, and implementation, especially among local communities, indigenous peoples, and citizens who will likely be adversely affected.

This case is therefore anchored on the Kenyan government’s obligations on transparency and accountability in relation to sovereign borrowing. Those obligations arise under both domestic and East African Community Law. Kenya’s 2010 Constitution together with the Access to Information Act, 2016, Public Finance Management Act, 2012, as well as the rule of law, transparency and accountability principles in the East African Community Treaty, require the Kenyan government to offer universally available, freely accessible, accurate, and complete financing arrangements information related to sovereign borrowing including in the debt swap arrangements that are the subject matter of this case.

The case is brought under Article 30 of the EAC Treaty. Article 30 of the EAC Treaty allows individuals and Non-Government Organizations who are residents of the community to bring cases against partner states of the EAC where these partner states violate the law. The case, thus alleges that the Kenyan government through its actions while considering, setting up, and implementing debt swap transactions, especially debt for nature swaps and debt for food security swaps to fund the budget deficit for Kenya’s financial year 2024/2025 lacks transparency, accountability, and public participation. The claims of lack of transparency, accountability, and public participation are violations of the provisions of the East African Community Treaty and Kenya’s domestic constitution (Constitution of Kenya, 2010) and laws on the principles of the rule of law, good governance, transparency, accountability, democracy, and participation of the people.

Through this case, the applicants are advancing three key goals:

• Giving the Kenyan government an opportunity to make public how it is adhering to its obligations on transparency in negotiating and procuring the debt swap transactions it has announced. This accords with the Kenyan government’s obligations not to negotiate or transact these debt swaps in secrecy and to avoid their negative consequences, as has been the case in other countries. This obligation of transparency and openness to public participation is consistent with prior decided cases enforcing the right to access to information - e.g in Khelif Khalifa & another v Principal Secretary, Ministry of Transport & 4 others (Constitutional Petition E032 of 2019) [2022] KEHC 368 (KLR) (13 May 2022) (Judgment).

• To stir a public conversation about debt swap transactions and in particular their advantages and disadvantages. Such a public conversation is only possible where the government is operating with transparency, accountability, and full disclosure.

• To offer a regional court the opportunity to affirm that transparency, accountability, public participation, and access to information in sovereign borrowing are key elements of the rule of law obligations in the East African Community legal regime.

The specific order sought from the Court is a declaration that the Kenyan government must make the following information publicly available:

(i). The specific contracts and/or indentures on debt swap arrangements that Kenya has entered and/or is currently negotiating.

(ii). Specific details on the type of debt swap arrangements that Kenya has entered and/or is currently negotiating, including their coupon rates, amortization schedules, as well as the principal and interest rate on each until each is completely paid off.

(iii). Specific details on the nominal value of debt, if any, to be reduced in the debt swap arrangements.

(iv). The specific legal entities established under Kenyan or foreign law that would act as legal advisors, investment bank, and other financial advisory firms and how much they will be paid?

(v). Specific details on how much, if any, debt cancelation will occur in the debt swap arrangements.

(vi). The specific details about how the proceeds of these debt swap arrangements will be put to including specific details about what the debt for medicine and debt for food arrangements will fund.

(vii). What nongovernmental conservation or other organizations the Respondent is working with on its debt-for-nature swaps and the transaction costs to be borne by the government of Kenya as well as all associated costs relating to their involvement including any payments that will be made to them under these transactions.

(viii). What process and procedures have been put in place to ensure public participation of communities that will be affected and/or are covered by the debt swaps, including the debt-for-nature swaps.

(ix). Which banks will act as the bond issuance arrangers in this debt swap arrangements as well as the costs to the government of Kenya associated with the services that they will provide.

Questions relating to this case should be directed to: James Thuo Gathii at james.gathii@gmail.com with a copy to: Afronomicslaw@gmail.com.

About Afronomicslaw

Afronomicslaw specializes in knowledge production on issues of international economic law and justice as they relate to Africa and the Global South. Established in 2019, a major goal of Afronomicslaw is to amplify the voices and issues relating to Africa and the Global South in the scholarship, advocacy and practice of international economic law. Afronomicslaw is the convenor of the African Sovereign Debt Justice Network (AfSDJN); the host of the African Journal on International Economic Law (AfJIEL); as well as informative articles, book reviews, Indaba (important conversations) and webinars. It also hosts the Afronomicslaw Academic Forum which convenes hundreds of students interested in economic law across Africa.

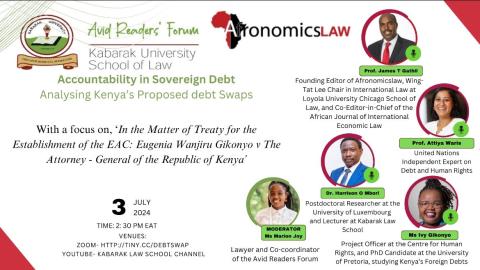

A webinar on the case will be hosted by the Kabarak University School of Law Avid Readers Forum on July 3rd 2024.