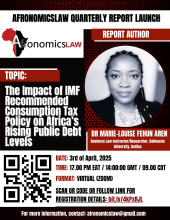

Invitation - Afronomicslaw Quarterly Report Launch: The Impact of IMF - Recommended Consumption Tax Policy on Africa's Rising Public Debt Levels

Join us for the launch of Afronomicslaw’s latest quarterly report, "The Impact of IMF Recommended Consumption Tax Policy on Africa’s Rising Public Debt Levels" by Marie-Louise Aren. This report critically explores the IMF’s consumption tax policies and their adverse effects on borrower nations, particularly in Africa and the Global South. It examines how the IMF’s emphasis on consumption taxes like VAT, when used as a tool for revenue mobilization, often leads to regressive outcomes by exacerbating inequality, increasing poverty, and contributing to unsustainable public debt.